- You are here:

- Home

- Blog

- Careers

- The Mindset You Must Adopt to Make More Money

99 percent of people on planet earth care deeply about money. Aside from Tibetan monks, priests, nuns, and a few truly dedicated (and weird) minimalists, money is always near the top of our minds because, in most situations, it has to be.

Until the world suddenly runs on a different currency, maybe toilet paper, you’ll be focused on money your entire life. And if you’re like the vast majority of the population, you’ll be thinking about money the wrong way.

But, if you shift your mindset, you can bring a lot more money into your life.

You’ve been taught to have a poor person’s mindset. Many people end up poor through no fault of their own. The circumstances of having no money too easily spill into the psychology of being poor. Poverty causes a mental a catch 22 scenario. Even for people who didn’t grow up destitute, you’re just not taught how to be rich.

You can be broke, but you never want to be poor. When you have a poor person’s mindset, you’re creating a psychological barrier that keeps you from getting money because you simply don’t expect to get any. And who’d blame you? Certainly not me.

Let me be clear — this isn’t your fault.

You’ve been misled. It’s not natural to think of money the proper way because you’ve been taught to think about it the wrong way for most of your life. Let’s be on the same page. I get where you’re coming from and why you see money the way you do, but now, it’s time to change that.

The Mindset Shift Critical to Earning More Money

Money is abundant. It’s everywhere. Even now.

If money is everywhere, then why does it feel so scarce to you?

You’ve been taught to think about money through the narrowest lens you could possibly use. When you have one source of income from an employer, and you do this for years, you come to think of it as the only possible way to make money. Yeah, the ads on Facebook about building an online business look cool, but you don’t really believe them.

You know that entrepreneurs exist. You know that investors exist. But you’ve been led to believe that you can’t be one of those people and are left to share a small piece of a finite pie.

So how do you shift that mindset and begin to see that money is everywhere?

Just start paying attention to how an economy works:

- You’re a part of transactions all the time. You buy something you want, value, and the other party gets the money. Think of how many times you do this. Do you really think you’re so inept that you can’t become part of that equation, somehow?

- When you buy something you want, you almost never get the sense that you’re giving your money away to someone else. No, you look through the lens of getting what you want. If people value what you have to offer, they’ll feel the same way about buying from you. You’re scared to sell because you don’t understand how valuable you are.

- Chrony capitalism and corporate welfare aside, at a basic level the transactions for goods and services improve the quality of life for everyone as a whole. The media tells this story of scarcity, while thanks to the free market, you can basically have anything you want delivered right to your door, watch anything you want whenever you want, and afford things that used to be luxuries in the past.

Why does the money never ‘trickle down’ to you?

Because you’re on the wrong side of the equation.

You consume, buy, and take on many expenses that pay other people — but you only produce value through one vehicle, your job. Not only is your job a limited vehicle, but it’s also not even a safe one. Tweak a few variables and your job can be gone in an instant.

This is important to understand. You don’t mitigate risk from having a job, you exacerbate it. Unfortunately, we’re experiencing this during the coronavirus epidemic. How many safe and stable jobs have been wiped away because of a freak occurrence? And, no, these displaced people can’t just up and learn new profitable skills in an instant, so they are screwed and money is scarce for them right now.

This is a lesson for you. Get on the right side of the equation so when this happens next time, you’re ready for it.

Switch your mindset to understanding that, out of all the available capital in the world, the fraction of it that you need to live an amazing life is small.

Let’s say that the number for you is $100,000. Can’t you capture $100,000 from a $19.3 Trillion dollar economy? Sure you can. You just have to start…doing it.

Choose a Model and Stick With It

There are so many business models that work well, especially online:

- E-commerce

- Affiliate marketing (even in the current climate, you could still start one of these businesses right now by starting a blog that cost less than $5/month and learning SEO)

- Blogging and self-publishing

- Freelancing (such a wide variety in here too) + the ability to take on employees and turn into an agency

- Coaching

- Content creation, e.g., YouTube and Podcasts

And let’s look at the not sexy businesses you can start:

- Real Estate – I’m no expert on this, but a reasonably compensated person who saved money over time can buy a property and turn it into more.

- Franchises – I used to work at a digital marketing company. One of our clients owned multiple dozen cleaning company franchises, eventually rolling that into the purchase of apartment buildings. You can buy a partnership in a Steak n’ Shake franchise for $10,000 and make $120,000 a year.

- All sorts of blue-collar business – It’s not sexy, but people will always need their toilets fixed, lawns trimmed, kitchens remodeled, whatever. The goal here is to learn how to scale up and not just become a self-employed laborer. (Here’s a great book on how to do that)

- Flipping – My uncle goes to car auctions, buys cheap cars, and sells them at a markup. You can do this with items on craigslist.

I could keep going here. I’m looking down at a pen as I write this draft. Some person, some no-name, owns this pen company and probably has millions. PENS.

The minute you make that switch from producer to consumer and understand there’s some pocket of the economy that could use some help — either a service or product — based on a skillset you either have right now or can develop in the future — then you’ll build the foundation to earn more money.

The Hardest Part About Making this Mindset Switch

The main issues you have comes from your societal conditioning around money, specifically when you get it.

See, if you want to get an abundance of money in the future, you’re going to have to sacrifice earning it upfront. This is called frontloading. See, the thing about getting started that sucks? Nobody knows who the hell you are or trusts you enough to buy from you or consume your content yet.

You probably don’t have the skills and acumen to pull it off yet. And to get those skills, you’ll have to put in at least some work up front with little to no reward.

And, on top of that, you still have to eat. You want to quit your job, but to get there, you first have to have two jobs. Or, if you’re laid off, an unpaid internship. Pat Flynn, the owner of the mult-million dollar blog Smart Passive Income, started his online business because he got laid off. He used his time wisely.

My best piece of advice for you? Just take it an hour or two per day, extremely gradual, and in a couple year’s time it will work, maybe even shorter depending on how well you can focus.

Find a lane that makes sense to you and stick to it. Staying focused is the hardest part. The steps involved in frontloading the work aren’t difficult, but doing each individual step, many without seeing an immediate payoff is hard.

But once it does start to pay off, as soon as you make any sort of money is a passive or scalable way, you’ll be hooked. And you’ll truly see that income is available everywhere.

Stack Streams on Streams

After you get one of those income streams to work, you’ll start noticing that other streams are available and you can start pouring money into those streams.

You’ll understand why the rich get richer and why they seem to find money everywhere when you used to not be able to. Wealthy people continue to create income streams and vehicles. That’s it. As soon as you start doing this yourself, you’ll realize how limited your mindset about money is.

Right now my income streams are:

- Medium writing

- Book royalties

- Affiliate marketing

- Monetized YouTube channel

- (Soon to launch) online course

- (Soon to launch) coaching programs

- Investment accounts

In the future I plan on:

- Real estate

- Owning a marketing agency

- Buying entire businesses

- E-commerce

- Public speaking

- Events

These are just a few of the ideas I have floating around in my head. I am not rich, yet, but I will be because I see so many opportunities out there and realize it’s simply a matter of capturing more value over time and putting that value right into something else that produces value. That’s the whole game.

The Truth About Money

Most people know everything I just talked about. As much as we claim this huge lack of financial literacy in society, people know how to make money — at least the vague basics.

Money doesn’t have a ton to do with what you know as Morgan Houseful puts it so well:

The finance industry talks too much about what to do, and not enough about what happens in your head when you try to do it.

You have to train your mind that money is available everywhere because you’ve been trained to believe the exact opposite. You have a huge confirmation bias well to dig out of. And, as I said earlier, your best chance is to shift your mindset very slowly and gradually over time.

When you don’t have money, fully believing in the abundance of money isn’t possible, so first, begin by building profitable skills. Then, you make a teeny tiny bit of money. Just seeing it’s possible to generate non-employee money can be enough.

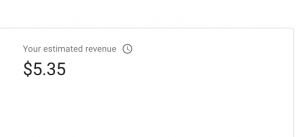

I just monetized my YouTube channel after 8 months of grinding to meet their watch hours quota:

You see a tiny amount of money that barely covers a cup of Starbucks coffee. I see the seed of another stream that will allow me more resources to continue to do what I love.

Of course, the vast majority of people don’t pull this off. Duh. But good thing you’re not one of those people.

Now is the time.

Have no profitable skills? Get some. Use your downtime to plot, plan, learn, and eventually turn those skills to money. Stop thinking like a poor person. You’re not destined for this lot in life, at all.

Whether or not you get out of it? 100 percent on you.